ASFPM’s Detailed Priorities for 2022 NFIP Reauthorization and Reform

The National Flood Insurance Program’s last multi-year reauthorization expired on Sept. 30, 2017. Since that time, the program has experienced 21 short-term extensions — with the most recent set to expire on Sept. 30, 2022.

In our continued efforts to push for significant reform and long-term NFIP reauthorization, ASFPM has put together a detailed priority list of what it hopes to see happen with the federal flood insurance program. The priorities address key components of the program, such as flood risk mapping, flood insurance, and mitigation as well as a selection of additional measures that ASFPM feels will strengthen the NFIP and advance equitable flood risk management across that nation.

The priorities are outlined below, or you can download the six-page fact sheet.

FLOOD RISK MAPPING

Reauthorize, fund and enhance the National Flood Mapping Program

- Support increased authorization of appropriations from the current funding level, which will never be able to complete and update the national mapping effort. An authorization of $1.8 billion (at $800m/yr) is necessary to substantially map all riverine and coastal flood areas in the nation, incorporating the additional mapping tasks required in BW-12 within five years:

- expedite the completion of flood mapping for every community in the United States within five years. It is essential to get accurate flood mapping in place ahead of development and taxpayer investment in infrastructure.

- prioritize the elimination of the paper map inventory.

- require all A-Zones to be model based with updated topography, and;

- prohibit digital conversion of flood maps unless a new engineering model backed study is done.

- Assure inclusion of all the BW-12 NFIP floodplain mapping requirements are shown as layers on the digital maps;

- utilize future condition projections of relative sea-level rise, increased storm frequency and intensity, updated and future-expected precipitation and projections of future development;

- map all populated areas and areas of possible population growth located within the 100-year and 500-year floodplains and provide analysis and data for the 10-, 25-, 50-year events;

- map areas of residual risk, including areas that are protected by levees, dams, and other flood control structures, ensuring this information is publicly accessible; and

- identify the level of protection provided by flood control structures.

- Map a full conveyance floodway as the required floodway in the mapping process. This will limit base flood elevation increases and expansion of the floodplain limits caused by the current impractical and untenable practice of mapping an artificial 1-foot floodway surcharge.

- Promote integration of floodplain and wetland (natural resources) mapping.

- FEMA must coordinate with other federal agencies to:

- prioritize the completion of high-quality, nationwide topography (3-DEP) to accurately depict flood-hazard areas;

- update precipitation data used in flood studies (Atlas 14 at least every 5 years on a nation-wide basis and include future conditions scenarios; and

- expand and improve the stream gage and tidal gage networks.

- Update the NFIP regulations and standards as begun in the FEMA 2021 RFI as per the ASFPM/NRDC petition for rulemaking, including necessary upgrades, including:

- require freeboard 2 feet (or 3’ for critical actions) above the base flood elevation;

- avoiding increased development in SFHA, and;

- providing changes that help eliminate the SRL properties (including increasing ICC funding caps and funding availability).

- Sponsor pilot efforts, with CTPs, to support pluvial mapping efforts and display local flood risk data with FIRM data.

- Remove the $35,000 cap on NFIP Emergency Phase insurance policies

- Evaluate the need for additional flood risk zones to reflect new mapping scenarios.

FLOOD INSURANCE

Ensure the already ongoing expansion of private-sector flood insurance does not erode the nation’s comprehensive flood-risk management framework (NFIP) already in place:

- Adjust the requirements on private flood insurance to assure it does not weaken the NFIP and provides similar services.

- Amend existing law to require an ‘equivalency fee’ (equal to federal policy fee) on all private flood insurance policies for base coverage to help pay for flood mapping and floodplain management (essential tools to help communities and states manage flood risk so private insurers remain viable).

- Amend existing law to explicitly require that private flood policies, which are sold to meet the federal mandatory purchase requirement, are sold only in NFIP participating communities.

- Amend existing law to require that private-sector flood insurance providers share comparable policy data in the same frequency and detail as FEMA shares to the private sector and as FEMA makes available to states and local floodplain managers, and require a repository for all flood insurance claims data for NFIP and private flood insurance.

- Eliminate “discretionary acceptance” for private flood insurance policies which allows lenders to decide whether to accept private policies—this is in direct conflict with existing statute.

- Ensure that consumers know the coverage limits and other differences between private flood insurance policies and NFIP policies by requiring private policies to include a summary of differences between NFIP and private policies.

- Continue to require that private flood policies have, at a minimum, comparable coverages and deductibles as NFIP policies, including a requirement to pay for mitigation similar to the Increased Cost of Compliance benefit.

- Require language in state insurance regulations to ensure private flood insurers report claims data to the appropriate state agency and communities so they are able to identify and track substantial damage and repetitive loss properties.

- Ensure the NFIP does not become the “insurance program of last resort/residual program,” resulting in having only the highest risk policies in the NFIP portfolio.

- ASFPM would support the provision of continuous coverage between private and NFIP policies only if an equivalency fee is imposed, private policies meet the mandatory purchase requirement, and are sold only in NFIP participating communities.

- Require NFIP participating states to have authorizing legislation to provide full flood-risk disclosure for all property transactions (purchase and rental agreements) prior to closing on sales or signing of rental contracts.

- Ensure flood insurance claims are adjusted and paid fairly and timely.

- Oppose any exemption of certain classes of buildings from mandatory purchase.

- Improve insurance agent training on flood insurance to include mandatory training and continuing education, such as a minimum four hours/year of such education for renewal of a property and casualty insurance license.

- Consider some limitation on the maximum number of insurance claims per property. This will help limit taxpayer exposure, but the limitations must be tied to an offer for mitigation assistance.

- Consider requiring that all property owners obtain and maintain flood insurance.

- Implement a targeted, means-tested, affordability mechanism that does not create a new subsidy or cross-subsidy within the NFIP.

- Rather than providing subsidies to NFIP insurance, consider better ways to subsidize and support mitigation efforts by individual property owners and the community as a whole.

- Forgive the current NFIP debt and adopt some form of a “sufficiency standard” as an automatic long-term mechanism within the NFIP that ensures, after a certain threshold of catastrophic events, the debt will be paid by the U.S. Treasury. Among other things, the sufficiency standard would consider the reserve fund balance, utilization of reinsurance, and ability of the policy base at that time to repay.

- Eliminate the policy surcharge. If the policy surcharge remains, use the proceeds of the surcharges, imposed by the HFIAA 2014 legislation to support the Increased Cost of Compliance (ICC) program funding, to boost cost-effective mitigation and reduce losses to the National Flood Insurance Fund and taxpayer disaster relief

- Address affordability when building is substantially damaged and do not require insurance on ag building valued at less than $1.000.

Support and enhance Increased Cost of Compliance

- Increase ICC limit to at least $90,000. This is needed to reflect substantial increases in building construction and mitigation costs over past decades.

- Require FEMA to modify current policies and fully implement all aspects of ICC already in statutes, within one year of this NFIP reform, including:

- require ICC claims to be paid in addition to the maximum claim limit under the standard NFIP policy;

- require ICC to be triggered by non-flood-related damage events, and;

- expand eligible items to be paid under ICC to be substantially similar to eligible items under the FEMA HMA grants, including cost of building acquisition and removal from high-risk areas.

Strengthen Risk Rating 2.0

- Adjust Risk Rating 2.0 to better support the connection between insurance and flood risk management, encourage true mitigation, such as freeboard and utility elevations, and ensure consumers are aware of and covered for their true flood risk.

- Inform/educate consumers that the FIRM maps will no longer be used to set insurance rates, but will be used for in/out determinations and local floodplain regulation requirements. Consider renaming the FIRMs so it is understood that they are for regulation and not for insurance rating.

- Develop tools and rate calculation transparency that show how all mitigation measures, including higher development standards, lower premium rates.

Enable flood disclosure and data sharing

- Provide flood insurance claims data sharing and access for property owners, buyers and renters, as well as local and state flood risk/mitigation programs.

- Provide an exemption to the Privacy Act to allow access to certain claims and insurance-related data, including repetitive loss and claims information, which does not contain personally identifiable information.

- Assure timely and efficient access to flood insurance claims data (PIVOT) for community and state floodplain and emergency managers, mitigation programs, appropriate research entities, and purchasers, renters or occupants.

Enhance Community Rating System (CRS)

- CRS incentives should benefit the community as well as policyholders.

- CRS credits must be changed to eliminate credit for activities that encourage development in the SFHA.

- In addition to benefits for policyholders, a portion of the CRS savings provided by premium discounts should go to the community to incentivize flood risk mitigation.

- Incorporate appropriate recommendations for changes from the 2021 FEMA Request for Information on re-imagining the CRS program.

MITIGATION

Emphasize the importance of mitigation in managing flood risk.

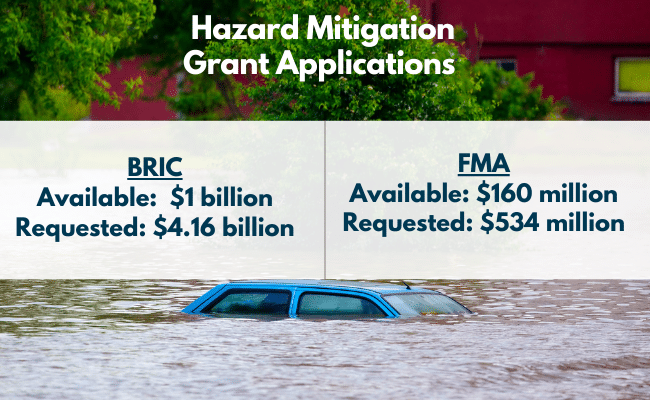

- Ensure that Stafford Act mitigation programs (BRIC and HMPG) support the flood loss reduction goals of the all NFIP programs and priorities:

- Prioritize traditional mitigation activities to ensure structure buyouts, elevation, and acquisition and relocation are competitive and funded in the mitigation programs grant process.

- Provide a larger state set aside in grant programs to foster local/state traditional mitigation activities.

- Fund advanced mitigation planning.

- Support pre-disaster mitigation of at-risk structures, especially repetitive loss.

- Explore requiring annual flood mitigation assistance (FMA) funding requests to support mitigating 5% of the repetitive loss properties/year.

- Ensure FMA is also available not just for repetitive loss properties, but also for high-at-risk properties that may not yet have suffered a loss.

- Provide improvements to the FEMA mitigation programs to support and ensure state programs have the means to provide all communities the needed technical. assistance to apply for and administer mitigation projects and actions.

- Provide cost-share funding in the mitigation programs to increase state capability for mitigation so states can assist communities in mitigation.

- Planning and designs for mitigation projects must consider future conditions.

- Non-structural and nature-based mitigation should receive equal footing with larger, traditional structural projects in all projects.

- Mitigation actions must better meet social/environmental justice and equity goals.

- Ensure all mitigation activities require use of the Uniform Relocation Act for buyout activities.

- Ensure that state and local mitigation plans, priorities and data are considered in awarding mitigation funding and satisfy social and environmental equity.

- Reevaluate the use of B/C as a criteria or decision tool for existing and future risk for mitigation projects. Loss of life and homes, social justice, and ecosystem restoration must become the focus of benefit-cost analysis criteria.

- Help more homeowners retrofit their homes to the growing threat of climate-related flooding through increased and more flexible NFIP-related funding.

- Explore options to get mitigation funding to property owners when a community may not have the capacity to apply for and administer grants (e.g. use and support states’ mitigation capabilities).

- Establish a pilot program to fund proactive buyout of undeveloped land. Better utilize non-profit entities for buyouts of open space by broadening the concept of beneficial use, e.g., allow NGOs to buy the land and sell, make available, or donate lands to the community.

- Use pre-flood acquisition and allow property owners to remain in their structure until the next flood or they decide to move out.

- Require FEMA to develop and execute a comprehensive repetitive loss strategy, including a requirement to go to full actuarial rates after a certain number of claims, unless a mitigation offer is accepted and used.

OTHER

Additional measures that will strengthen the NFIP and advance equitable flood risk management in the nation:

- Ensure the goals of EO 13690 (FFRMS) are incorporated into the NFIP reauthorization so that federal taxpayer assets and investments consider, plan for, and account for current and future flood risk.

- Ensure the NFIP works with communities and states to ensure it is equitable and fair for socially or economically disadvantaged populations.

- Authorize the Community Assistance program (CAP-SSSE) including funding at a minimum of $20 million, to ensure support mechanisms for building capability at the state level to efficiently and effectively assist communities manage and mitigate their flood risk.

- Ensure that NFIP regulations allow for maximum inclusion of state/community higher standards.