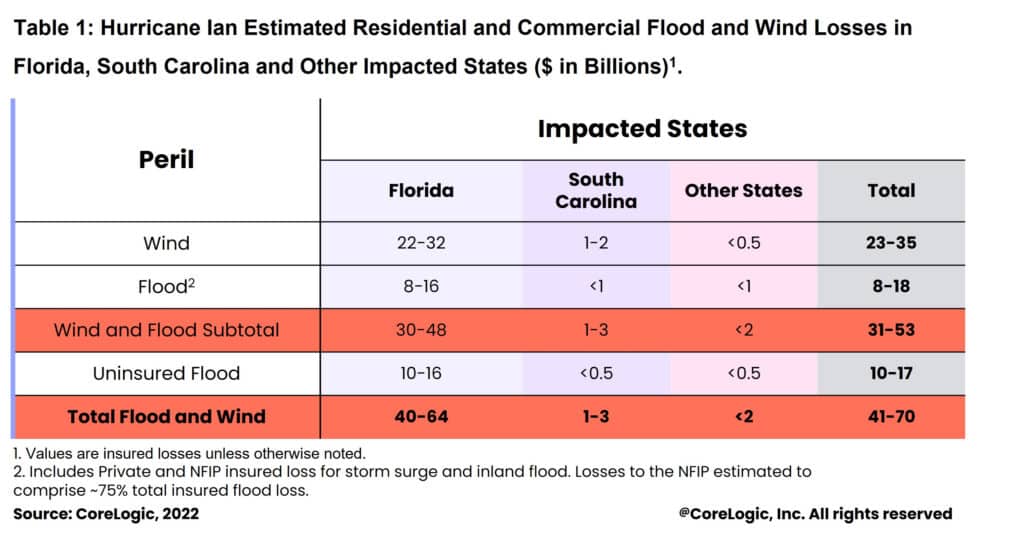

Estimated Damage for Hurricane Ian Between $41 Billion and $70 Billion

Uninsured residential flood loss is between $10 and $17 billion

The projected price tag for Hurricane Ian continues to rise with the updated estimate from CoreLogic putting the total flood and wind losses between $41 billion and $70 billion. That’s up from the initial estimate of $28 billion and $47 billion.

According to this new data analysis released on Oct 7, this estimate (Table 1) includes wind loss, re-evaluated insured and uninsured storm surge loss, and newly calculated inland flood loss for residential and commercial properties.

- Flood loss from NFIP and private insurance for residential and commercial properties is estimated to be between $8 billion and $18 billion, which includes both re-evaluated storm surge and new estimates for inland flooding.

- Uninsured flood loss for this area is estimated to be between $10 billion and $17 billion.

- Wind losses are estimated to be $23 billion to $35 billion.

“The key reason Hurricane Ian is so economically destructive is due to the massive growth in coastal real estate in Florida,” said Tom Larsen, senior director of Hazard and Risk Management, CoreLogic. “Florida’s population has grown 50% since 1992 when Hurricane Andrew hit Miami, with disproportionately more growth in South Florida. The extra costs incurred from the surge in repair needs simultaneous with a fragile economy are headwinds to rapid reconstruction and we should expect to see resident displacement and housing affordability issues in the state for some time to come.”

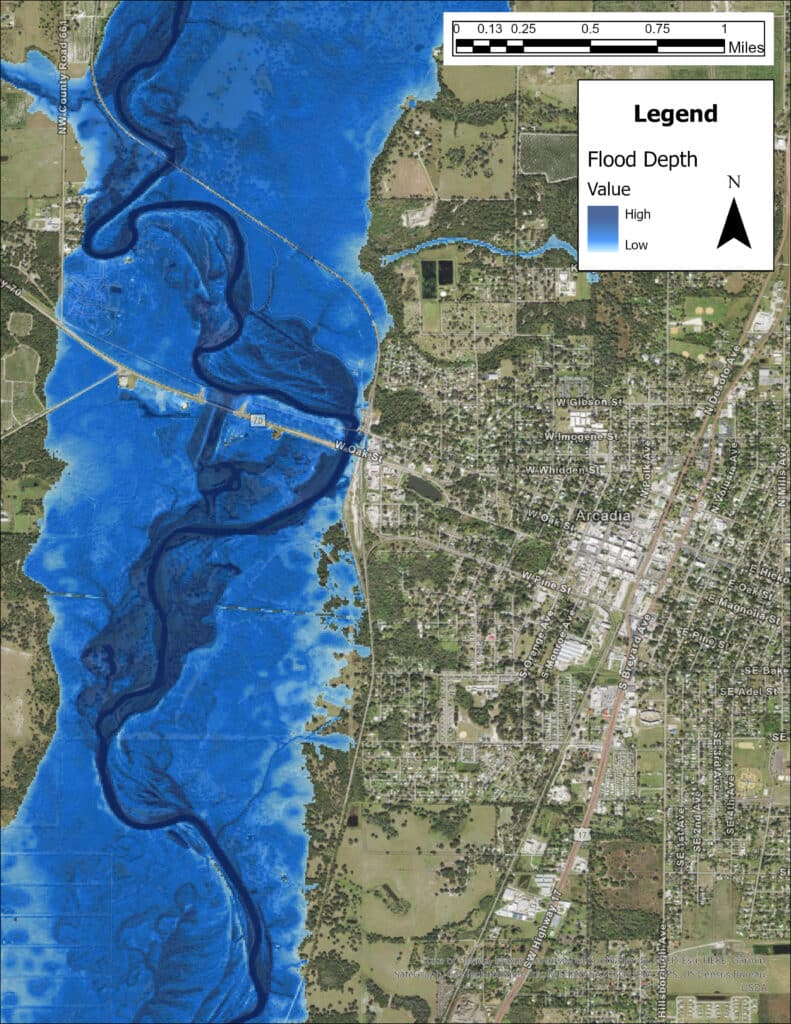

The firm’s analysis found extreme inland flooding due to significant riverine flooding along Peace River in Arcadia, FL, located south of Tampa, FL and north of Punta Gorda, FL. Peace River, which normally runs 130 feet wide, flooded to more than a mile wide due to Hurricane Ian surge and rainfall. However, this area is designated as a Special Flood Hazard Area (SFHA) by FEMA and housing is sparse in this location (see Figure 1).

“In many areas the flood extent approximates the SFHA boundaries, a clear indication that SFHA is a useful tool for city planners who wish to understand flood risk and mitigate flood damages,” said Larsen. “Without constraints in development in the SFHA, flood damages would have skyrocketed. Learning from this riverine flood event will help city planners make better decisions about where residential development makes sense, from standard construction homes to manufactured home communities.”

Housing Impacts of Hurricane Ian

According to CoreLogic analysis, Florida had been a primary destination in the great migration trend of 2020 and 2021 due to the state’s lack of income tax and housing with lower cost per square foot than homes in major coastal metros like New York City and San Francisco. Additionally, residents have enjoyed increasing home equity gains throughout 2022, with homeowners reaching an average equity all-time high of nearly $300,000. Disasters like Hurricane Ian, however, may put a damper on the state’s housing growth.

“Housing markets in Florida will face difficult times as many Florida residents have been impacted by the devastating storm,” said Selma Hepp, interim lead of the Office of the Chief Economist, CoreLogic. “Initially, we are likely to see an increase in mortgage delinquencies as is typical following catastrophes. Also, rents are likely to jump as households who lost their home seek immediate shelter. Longer term, home price growth in hard hit areas is likely to lag that of the rest of the state and nation as people may opt to move to areas less prone to natural disasters. CoreLogic observed this trend in the Gulf Coast region following Hurricanes Laura, Delta and Ida.”

According to CoreLogic, more than 66,000 pending mortgage applications worth nearly $22.5 billion are currently in progress in Florida, North Carolina and South Carolina and are in jeopardy from Hurricane Ian damages.

More Information on Damage Estimates

Insured loss represents the amount insurers will pay to cover damages. The analysis includes residential homes and commercial properties, including contents and business interruption and does not include broader economic loss from the storm. The inland flood analysis is based on the rainfall from September 25 to October 4.

Visit the CoreLogic natural hazard risk information center, Hazard HQ™, at www.hazardhq.com to get access to the most up-to-date Hurricane Ian storm data and see reports from previous storms.

In addition, CoreLogic is hosting a webinar on Oct. 13 at 12:00 pm ET titled Hurricane Ian: The Story Unfolds.

This 45-minute briefing will cover:

- The storm, the flooding, and its impact

- An An ‘in the trenches’ look at the response and the technology available to accelerate recovery

- A loss recap with a deep-dive into flood loss estimates.

- The effects of inflation

- What it all means for housing affordability