Risk Rating 2.0 Talking Points and Resources to Help You Navigate the Changes

FEMA’s long-awaited Risk Rating 2.0 rollout is now underway as the agency announced April 1 that NFIP flood insurance policyholders will see a new system calculate their premiums. FEMA should be releasing more details in the coming days on its Risk Rating 2.0 webpage, and ASFPM will pass along any noteworthy information to our stakeholders.

The new NFIP rating system is designed to be more equitable and easier to understand than the current system, which relies on antiquated insurance rating practices. Eventually, the new ratings system should put the NFIP on a path to financial sustainability. As floodplain managers, you will likely get inquiries from the public, your agencies, elected officials, or local media. Over the past week, ASFPM has been able to gain some valuable insights into Risk Rating 2.0 and the information below provides some talking points you may use as you see fit.

- Risk Rating 2.0 is designed to establish insurance premiums. It does not change how Flood Insurance Rate Maps (FIRMs) and Flood Insurance Studies (FIS) are used for floodplain management and regulatory purposes nor for lender compliance with the mandatory purchase requirement. The Special Flood Hazard Area (SHFA) will remain.

- With Risk Rating 2.0, flood hazard zones, rating tables, and elevations will no longer be the only factors used in calculating a property’s flood insurance premium. Instead, FEMA will be utilizing state-of-the-art industry technology with data from the NFIP, NOAA, USACE, USGS, and others to establish a new risk-informed rating plan that incorporates a broader range of flood frequencies and sources, including pluvial flooding (drainage and urban flooding due to heavy rainfall) and other coastal risks such as erosion. Risk Rating 2.0 will also factor additional geographical variables, such as the distance to water, the type and size of nearest bodies of water, the elevation of the property relative to the flooding source, and building specifics (e.g., replacement cost). As proposed, NFIP premiums calculated under Risk Rating 2.0 will reflect an individual property’s flood risk (rather than national averages).

- FEMA has partnered with the USACE to develop the necessary statistics and information to develop what ASFPM believes will be a superior, actuarially sound, and far less complicated approach to rating structures protected by levees. This provides a significant opportunity to close the insurance gap in residual risk areas around levees.

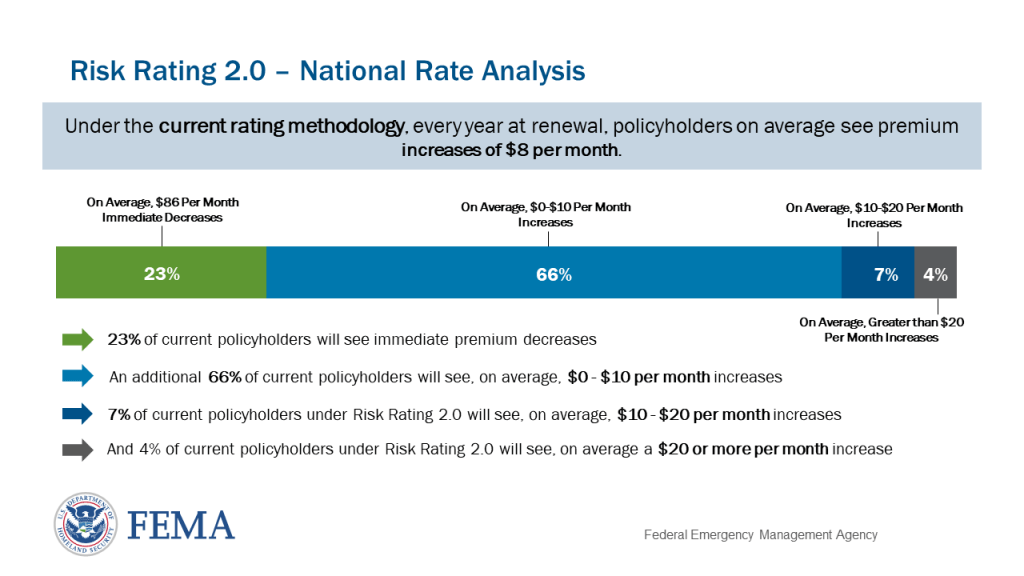

- What this new methodology will mean for policyholders will vary, of course, but most can expect a reduction or minimal change in premium costs. Fewer will see an increase in premiums. Only 4% of policy holders nationwide are expected to see substantive increases, this percentage however, varies from state to state. In a national rate analysis of current policy holders, FEMA says:

- 23% will see immediate premium decreases;

- 66% will see, on average, premium increases of $0-$10/month (which is around what the average is now);

- 7% will see, on average, premium increases of $10-20/month;

- 4% will see, on average, premium increases of $20 or more per month.

- FEMA has released Risk Rating 2.0 profiles for each state, which provide a similar breakdown to the national data. These should be very useful for explaining impacts of Risk Rating 2.0 in a particular state. The fact sheets also provide statistics about average Individual Assistance payments versus average flood insurance payments, and mitigation measures for reducing rates. Find your state profile here.

- In terms of equity related to cost, it appears the more robust actuarial rating approach will decrease rates for lower value homes and those with more expensive homes could see some increases. While this doesn’t solve the flood insurance affordability problem for some, an unexpected and welcome benefit of Risk Rating 2.0 will likely be greater equity in the NFIP. It will be up to Congress to further address the affordability issue, although FEMA did propose an affordability framework in 2018. Congress will also have an opportunity to tailor an approach to affordability when they consider reauthorizing and reforming the NFIP, which expires at the end of September 2021.

- The new rating engine will help agents more easily price and sell policies. It’s expected that this engine will provide transparency to policyholders to better understand their property’s flood risk and how it is reflected in their cost of insurance. This will also eliminate the longstanding problem of people going to multiple insurance agents and getting different rate quotes for a property. We understand that FEMA is working on a public-facing interface that will let folks find the rate for their property and that it may become available later this summer.

- The new rate schedule takes effect Oct. 1, 2021 for new policyholders but not until April 1, 2022 for renewal of existing policies. This phased approach will allow time for existing policyholders to see the new rates and consider any mitigation steps they could take to lower their future insurance premiums. It will also allow time for the insurance companies that write NFIP policies to upgrade their systems to apply the new rates for renewals. Those existing policyholders wishing to take advantage of rate decreases at renewal can do so beginning October 1.

- FEMA says Risk Rating 2.0 will provide the following key benefits to policyholders, communities, and the flood insurance industry:

- Creates an individualized picture of a property’s risk

- Provides rates that are easier to understand for agents and policyholders

- Reflects more types of flood risk in rates

- Uses the latest actuarial practices to set risk-based rates

- Reduces complexity for agents to generate a quote

ASFPM believes this change is long overdue and believes that it is important that a property owner understand their flood risk through an actuarial sound flood insurance rate. A more accurate, fair, and equitable way to determine an individual property’s flood risk should increase public confidence in the program and should put NFIP on stronger financial footing. There’s still much to be learned to ensure a smooth rollout. We’ll continue to provide updates and analysis as we learn more.

Current FEMA resources on Risk Rating 2.0

- NFIP, Risk Rating 2.0 Methodology and Data Sources, March 25, 2021

- Risk Rating 2.0 is Equity in Action

- Risk Rating 2.0 – National Rate Analysis (graphic)

- Risk Rating 2.0 State Fact Sheets

- Legacy Rating Program changes

- New NFIP Pricing Methodology Program Changes and Updated Guidance Effective October 1, 2021

- Risk Rating 2.0 Methodology and Data Sources -Premium Calculation Worksheet Examples (Excel spreadsheet)

- Risk Rating 2.0 Appendix D Rating Factors (Excel spreadsheet)

Updated Policy Forms to conform with changes to reflect BW-12 and HFIAA and additional clarifications for plain language.

- Residential Condominium Building Association Policy: Standard Flood Insurance Policy

- General Property Form: Standard Flood Insurance Policy

- Dwelling Form: Standard Flood Insurance Policy

Bookmark the FEMA Risk Rating 2.0 webpage to stay current on additional guidance and resources.